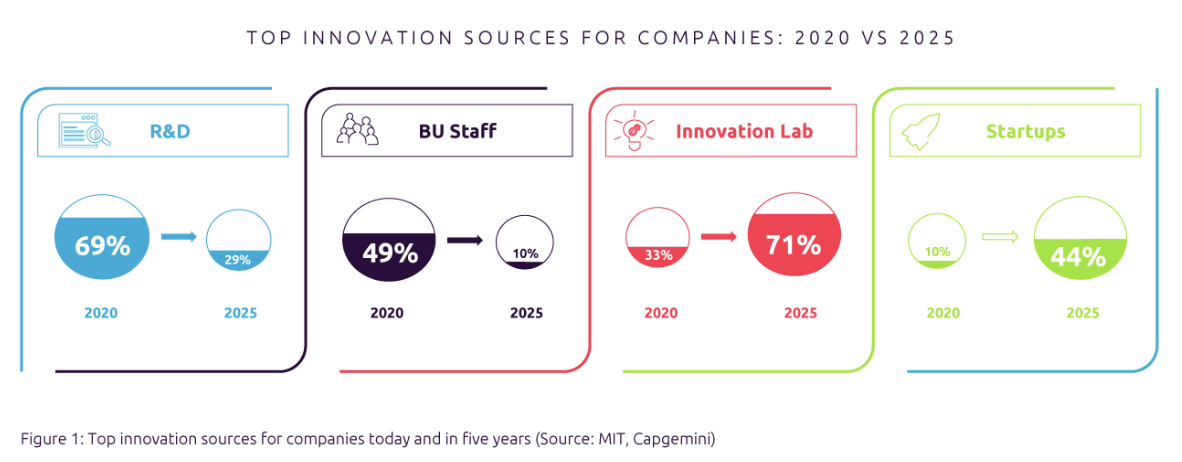

For decades, tools like accelerators, incubators, and CVCs have fueled corporate innovation by providing access to cutting-edge technologies, business models, and offers, opening the path for limitless possibilities. However, a new strategy is gaining traction: venture clienting.

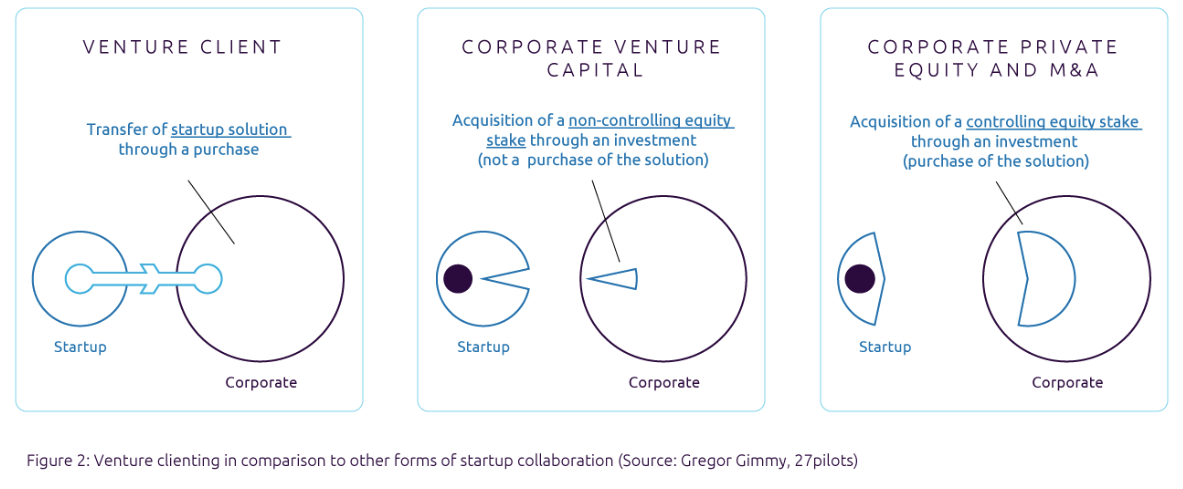

Corporates interact with startups as clients instead of partners, investors, or parent companies as venture clients. This method has the twin benefit of giving corporates quick access to unique ideas while also providing startups with the critical early revenue essential for growth.

You may have heard the term “venture clienting” a lot lately. But what does it mean? Is it advantageous for you and your organisation to become a venture clienting? This article will provide all the information you need to master this topic.

A venture client is a company that buys and employs startup products to incorporate them into its business operations. Venture clients look out for the most promising startups to assist them in addressing specific business difficulties, optimising processes, or improving the entire customer experience. And, because “any company that buys from startups is a venture client,” nearly every organisation is a venture client. After all, startups would not exist if other organisations did not employ their products. As a result, hundreds of thousands of venture clients range from large enterprises to small, ten-person firms (Gregor Gimmy).

Venture clienting entails considerable risks, particularly with young companies. It is not yet known that they will survive in the long run. However, it also entails numerous benefits.

Venture clients benefit from fresh solutions and unique ideas for their industry, putting them one step ahead of the competition. They are able not only to purchase brand-new products but also to shape and support their ongoing development. As a matter of fact, this allows them to foster internal innovation by incorporating new startup products directly into their development departments and work processes.

Extensive coordination processes and legal stage omissions make venture clienting far less complicated and faster than a joint venture or even the acquisition of startups. Venture clients can more easily leverage market advances for themselves without taking on huge risks. They might also be companies that lack the financial resources to participate as investors.

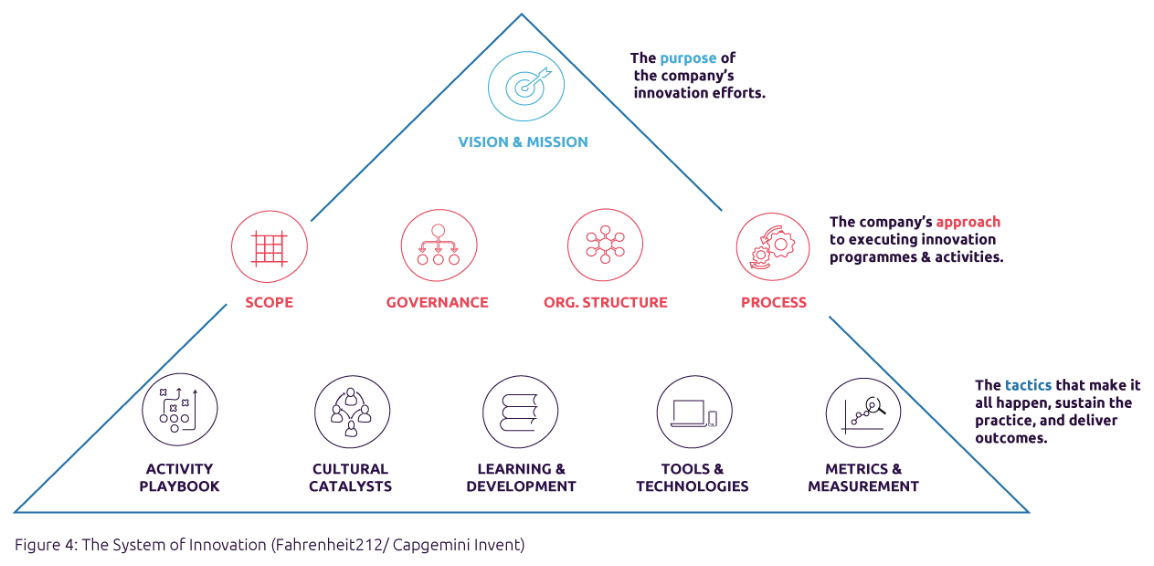

The good news is that venture clients can grow into any firm, from small businesses to giant corporations. When startups purchase new items from other companies to drive their own business, they have the potential to become venture clients. However, in order to invest in reliable companies and relevant products, it is necessary to bring in experts. This can be accomplished by developing their own venture client unit or by collaborating with experienced startup matchmakers who are familiar with the needs of established firms as well as the startup environment.

Corporations may benefit from establishing their own venture client unit. This serves as a bridge between the startup ecosystem and specific departments looking to incorporate innovative solutions into their procedures. BMW (BMW Startup Garage), Bosch (Open Bosch), and Siemens Energy (Siemens Energy Ventures) are among the companies that have established their own venture client departments.

These units not only specialise in locating suitable businesses, but they also assist in overcoming cultural barriers that can arise when established corporations and young startups collaborate.

Companies, on the other hand, require competence in innovation and startups in order to build venture client units. If this is not yet available in-house, it is best to engage experienced startup specialists and innovation managers or use external service providers rather than have staff rebuild the wheel.

Venture clienting is equally beneficial for small and medium-sized businesses. Startups, particularly in the fields of automation and digitization, can provide them with important solutions that assist to accelerate operations, give new added value for consumers, or relieve pressure on the team in times of a skilled labour shortage.

When it comes to the decision to buy startup products, SMEs have the difficulty of having limited financial and human resources to fall back on when compared to multinationals. To become venture clients while avoiding risks, businesses should collaborate with specialists who are familiar with the startup industry and can advise them through the entire process.

Creating a Corporate Venture Capital (CVC) arm that invests in early-stage companies is the typical way advised by academics and management consultants for businesses to acquire new technology, ideas, and talent. However, this traditional approach has significant drawbacks: it is expensive, inefficient, and lacks scalability.

As we all know, acquiring minority stakes in businesses costs millions of dollars per year and it is time-consuming. Furthermore, promoting the company to corporate business divisions also takes up time, effort, and resources.

CVC initiatives are only justified in certain situations. It is most effective when carried out on a large scale as a financial investment or to create a pipeline of future mergers and acquisitions. In other instances, CVC can be challenging, requiring a highly qualified workforce and participation in sectors that might not immediately affect the primary industry. Without a large-scale strategy, the possibility of substantial financial gains is reduced. This could lead to small ownership holdings in businesses that are also challenging to sell.

Venture clienting should not be seen as a stand-alone exclusive strategy but rather as a part of a more comprehensive and complex innovation framework. Its goal is not to take the role of internal innovation initiatives or to take the place of current departments working on innovation or business development. Instead, it enhances and adds value to these efforts as a helpful complement.

As a matchmaker for startups and established firms, we assist companies all over the world that wish to profit from the startup scene’s creative ideas and solutions. The Novable Agents assist our clients from the planning stage, through the identification of eligible startups, to the decision for the most appropriate form of partnership. Depending on the requirements, we assist our clients in overcoming specific innovation challenges, providing the most efficient startup scouting platform and service.

Novable complements the in-house AI-powered matching engine (DeepMatching™) with the expertise of a dedicated team. Not a search engine, or a database. It’s an enterprise-grade scouting technology delivering top-quality results based on your specific requirements. As such, every client has a dedicated Novable Agent to onboard teams on the platform, guide them through the intricacies of innovation and startup scouting, and provide all support needed at any time.

In our everyday work, we see how unique synergies emerge from the collaboration of startups and established organisations. If done correctly, venture clienting results in a win-win situation in which suitable partners are found.

Are you interested in learning more about how established organisations have integrated startup solutions? Check out our client stories page and follow us on LinkedIn to keep up with the latest trends.