In the dynamic landscape of venture clienting, the intersection between startups and established corporations has become increasingly vital for innovation, growth, and mutual benefit. As corporations seek new avenues for expansion and startups strive for scalability, the decision to collaborate is not one to be taken lightly. One key metric that plays a pivotal role in this decision-making process is the startup Activity Index.

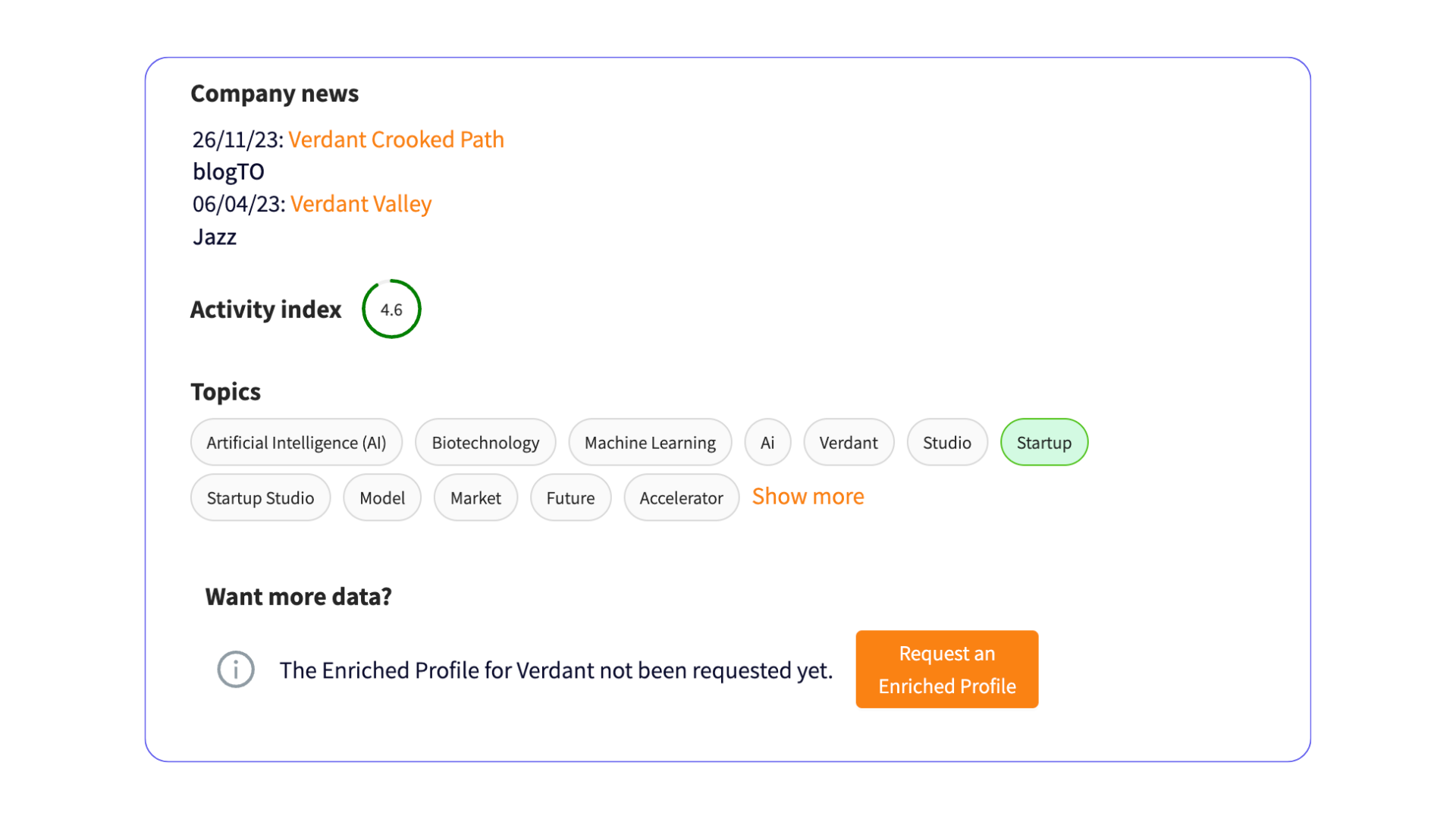

The Activity Index is a comprehensive metric that evaluates whether a company is active or not by looking at several dimensions and how it positions itself in the market. It encompasses various aspects of a startup’s operations, ranging from financial stability and market positioning to team dynamics and technological prowess.

The activity of a startup can be a compelling indicator for corporations looking to invest in emerging businesses. Let’s see the reasons behind it!

One of the primary reasons why the Activity Index is crucial in collaboration decisions is the inherent agility and innovation that startups bring to the table. Startups, by nature, are more adaptable to change and often possess a culture of experimentation. A high activity index reflects a startup’s ability to pivot quickly in response to market shifts, making them attractive partners for corporations aiming to stay ahead in a rapidly evolving business landscape.

Corporations seeking to maintain a competitive edge are drawn to startups that demonstrate a high level of market disruption potential. The Activity Index assesses factors such as the uniqueness of a product or service, scalability, and the ability to challenge traditional industry norms. For established corporations, collaborating with disruptive startups can be a strategic move to enter new markets. In this way, they would be able to reach untapped demographics or enhance existing products and services.

While innovation and agility are essential, financial stability and viability are equally critical. The Activity Index evaluates a company’s financial health, including revenue streams, cost management, and investment strategies. For corporations contemplating collaboration, a startup with a solid financial foundation signals a reduced risk of partnership failure and a higher likelihood of achieving shared objectives.

In today’s tech-driven world, startups often serve as hubs for cutting-edge technologies and top-tier talent. The Activity Index delves into the technological capabilities of a startup. It assesses the sophistication of their solutions and the expertise of their teams. Corporations seeking to leverage advanced technologies or tap into specialised skills find this dimension invaluable in identifying partners that align with their technological aspirations.

Successful collaborations extend beyond individual partnerships; they involve integration into broader business ecosystems. A high Activity Index implies a startup’s ability to seamlessly integrate into existing corporate structures, fostering a collaborative environment that maximises synergies.