Venture Clienting. Venture Clienting. Venture Clienting.

We have previously introduced the concept of Venture Clienting. In this article, we would like to share with you some insights from the State of Venture Client Report 2023.

The report’s main area of attention is the corporate world and the startup ecosystem’s awareness and comprehension of Venture Clienting.

Only 47% of businesses have heard of the term “Venture Client,” and even among them, it is rarely utilised internally. This is not surprising considering that the phrase was created by Gregor Gimmy and first used in a professional setting at BMW in 2014 before being adopted by academia in 2017.

The widespread acceptance and execution of Venture Clienting are severely hindered by the lack of understanding and a common language. Therefore, how would you be able to make the most out of Venture Clienting in your company?

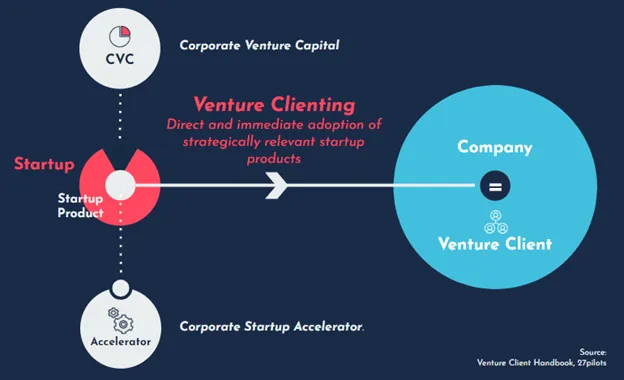

Clarifying the distinctive relationship between Venture Clients and startups, which distinguishes it from other types of corporate venturing, is essential to establishing a shared vocabulary and understanding.

The report states that the three main characteristics that most Venture Clients use to characterise startups are:

The cutoff for the Venture Client Unit is determined by a common definition of the term “startup” used throughout the organisation. It specifies precisely the kind of business the unit is searching for when trying to use new technologies to solve strategic difficulties. Furthermore, a precise definition of a startup establishes the standards for an exhaustive and comparable evaluation of startup solutions. Consequently, the suggested definition follows:

“A startup is a privately held, non-listed firm (= “legal entity”) managed by its founding entrepreneurs (i.e., humans, not companies), that uses a scalable product based on exclusive and protected Intellectual Property (IP) to solve strategically relevant challenges. Company businesses are typically VC-fundable, however VC finance is not a need for a company.”

Every business that has made at least one purchase from a startup, is a Venture Client. To facilitate the purchasing phase, several businesses have adopted a multi-step procedure. The survey revealed that the top 5 process phases that Venture Clients often follow are:

Having stated that, this process requires a deeper framework and a more systematic approach. The Venture Clienting methodology suggested in the report has been used and validated by numerous large international organisations. In order to speed up the process of identifying pertinent issues and promoting the adoption of cutting-edge startup solutions that best address them, each phase produces specific deliverables. The four processes are:

As a matchmaker for startups and established firms, Novable assists companies all over the world that wish to profit from the startup scene’s creative ideas and solutions. Every client receives help from a team of experts starting from the planning stage, through the identification of eligible startups, to the decision for the most appropriate form of partnership. Depending on the requirements, we assist clients in overcoming specific innovation challenges, providing the most efficient startup scouting platform and service.

While most businesses are aware of the strategic benefits of innovative companies, their top priorities are to use startups to enhance their products (85%) and processes’ (86%) quality. Purchases from startups are currently more operational than motivated by the strategic purpose of acquiring crucial technology, as indicated by the fact that only 14% of respondents regard Venture Clienting as a due diligence tool for mergers and acquisitions (M&A). However, by identifying the strategic needs that startups are best suited to address and verifying emerging solutions before obtaining them, a good Venture Client model has the potential to use purchasing from startups as a crucial component of a company’s innovation and inorganic development strategy.

To do this, businesses should create a Venture Client strategy that is in line with the corporate goal. Venture Clients may efficiently find startups that are ideal for finding solutions to challenges that are strategically important by specifying goals and areas of interest that are in line with the company’s strategy. By matching problem descriptions with internal demands and employing Venture Clienting as a startup-competitiveness vehicle, Venture Clients would strengthen their competitive edge.

For Venture Clienting to provide the greatest strategic advantage from startups, access to the appropriate resources is essential. Only a small percentage of businesses currently have specialised corporate venturing units with experts and funding. However, since Venture Client Units speed up the process of issuing purchase orders, which is critical for startups, it is imperative to integrate these functional areas in order to ensure smooth and effective operations.

Moreover, according to the analysis, a sizable majority of businesses (roughly 75%) rely on these suppliers for their Venture Client solutions and scouting/sourcing services. They help businesses easily traverse the startup scene by bringing their knowledge, networks, and tried-and-true processes to the table. Companies may build a strong ecosystem that maximises the efficiency of their Venture Clienting initiatives by utilising the experience of these external providers and incorporating all pertinent divisions inside the firm.

Being close to the business is essential, as is working with leading startups to jointly identify and resolve their strategic issues. Building a solid network and assigning roles at your Venture Client Unit are additional requirements.

Companies can increase the strategic impact of startups and provide a greater business impact by having the appropriate Venture Client resources and developing the necessary structures.

Both startups and Venture Clients can profit from the Venture Client model.

For Venture Clients, it offers a fantastic chance to access millions of new firms each year. With an annual investment in venture capital of more than $500 billion, these companies present a variety of innovative ideas and opportunities that go beyond the purview of the Venture Client firm. CVCs account for only 2–3% of total investment funds, according to a study done by 27pilots utilising data from CB Insights Corporate Venture Capitalists (CVC).

Only 10% of the startups in the CVC portfolio succeed in forming any kind of partnership with the CVC’s parent company. The Venture Client Model, on the other hand, stands out as a corporate venturing option that provides practical use of the startup’s product without investing in businesses. It provides a strategic advantage to businesses by successfully evaluating startup technologies before entering into a partnership or M&A, in contrast to a “financial tool” like CVC.

The Venture Client Unit gives startups a quick route to product-market fit. Furthermore, companies receive first-hand input from users in the field about their technology, which is crucial for enhancing their product, value proposition, and business model.

Novable blog (2023, June 27). What is Venture Clienting and who can do it? https://novable.com/what-is-venture-clienting-and-who-can-do-it/

State of Venture Client Report. (2023). State of Venture Client. Retrieved September 4, 2023, from https://stateofventureclient.com/

TechPulse, D. (2023, June 21). What is the State of Venture Client 2023? Medium. https://medium.com/@deloitte.techpulse/what-is-the-state-of-venture-client-2023-6810a29d2073