Innov8rs Milan 2024. Innov8rs Milan 2024. Innov8rs Milan 2024. Innov8rs Milan 2024. Innov8rs Milan 2024. Innov8rs Milan 2024. Innov8rs Milan 2024. Innov8rs Milan 2024.

Innov8rs Milan 2024 brought together a pool of worldwide innovators, providing a platform where leaders, thinkers, and doers converge to share knowledge and drive change. If you haven’t been able to participate and would like to know more about the event, this is the right article for you.

A corporate-startup collaboration represents a strategic alliance between a well-established corporation and a dynamic, emerging startup. This symbiotic relationship involves a mutual exchange of resources, expertise, assets, and capabilities aimed at achieving common business objectives, such as expansion and the exploration of additional revenue streams.

This partnership creates a synergistic blend, enabling each entity to pursue its growth aspirations with heightened agility and reduced risk compared to operating independently. Leveraging the external startup ecosystem empowers corporations to future-proof their operations, broaden revenue streams, and maintain a competitive edge in today’s volatile marketplace. Each collaborative venture serves as a testing ground, validating new technologies, models, products, and services within controlled environments.

Outbound Startup Scouting

Corporations have three main avenues for fostering innovation: build, buy, or partner. Companies can often use these methods simultaneously and should choose them based on their overall strategy and goals. It is important to assess the pros and cons of each option:

Partnering with startups is a significant strategy for driving corporate innovation. While this isn’t the sole method for innovation, combining it with internal R&D and considering M&A deals can yield comprehensive results.

In order to be successful, partnerships must be well-designed and executed based on clear objectives and resources.

Research by CB Insights shows that “60% of corporate accelerators fail within two years, and partnerships result in less than 1% of the time”, usually due to misaligned goals, founders lacking the help they need, and corporates going in with misleading expectations. This leads to the question: how do CAs identify the list of startups to assess?

Startup and new technology fairs, both virtual and in-person, have proven to be key locations for discovering innovative companies. They provide entrepreneurs with a venue and a set amount of time to present their products. But is it the most efficient way to do so? The answer is no! Just like universities and colleges with innovation laboratories, conferences on pertinent issues, and social media networking platforms (LinkedIn, Twitter, etc.).

To identify companies that are in line with the project, outbound scouting using startup sourcing tools that are designed to do so is key.

Access to a comprehensive database with classified information is required for effective sourcing. The strength of a database resides in its use. Novable covers over 3.5 million startups globally, allowing you to instantly scan and analyse the whole innovation ecosystem. It provides an extensive shortlist of relevant solutions that matter to you. Unlike traditional databases, it combines artificial and human intelligence and provides the perfect combination to discover the needle(s) in the haystack.

Engaging with Startups

There are 3 questions you need to address to establish clear goals for your interactions with innovation ecosystems and develop a targeted approach that aligns with stakeholders’ needs and preferences.

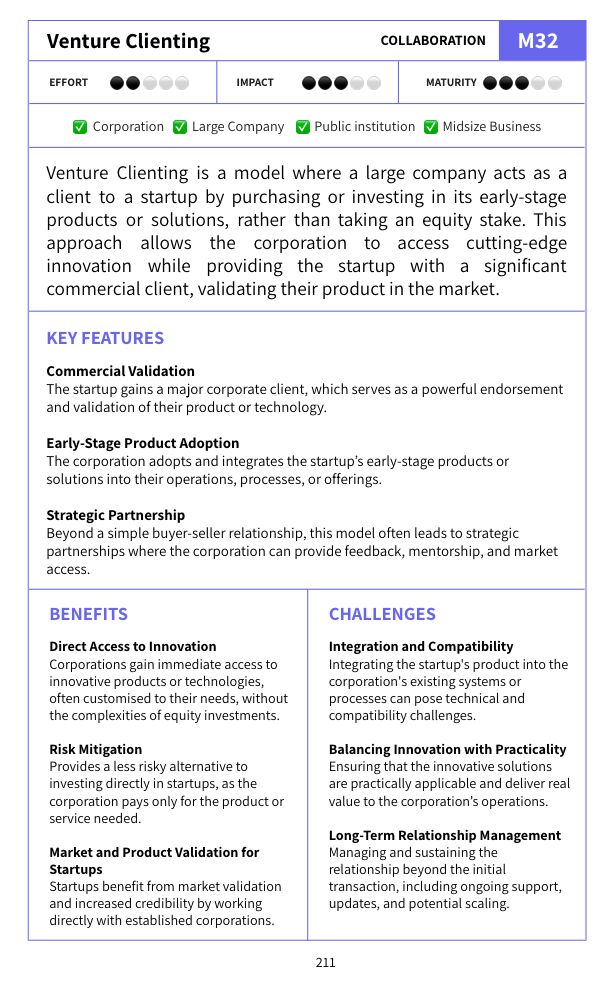

The buzzword of Innov8rs Milan 2024: Venture Clienting

According to the Venture Clienting Model, the corporate directly buys and adopts the products of startups to gain immediate and measurable strategic benefits. It bridges the gap between startups and corporates efficiently, bypassing the pitfalls of traditional models.

Venture clients benefit from fresh solutions and unique ideas for their industry, putting them one step ahead of the competition. They are able not only to purchase brand-new products but also to shape and support their ongoing development. As a matter of fact, this allows them to foster internal innovation by incorporating new startup products directly into their development departments and work processes.

As innovation budgets tighten, AI’s potential to enhance productivity and drive results becomes increasingly valuable. However, AI’s impact extends beyond mere cost-cutting. Let’s have a look.

Accelerating research. AI models like ChatGPT offer rapid, concise answers to queries, significantly speeding up research phases. This is especially beneficial for market research, allowing teams to familiarise themselves quickly with new topics without lengthy searches.

Enhancing ideation. Generative AI can produce a vast array of ideas for new projects and products in minutes. While not all ideas will be viable, AI helps teams explore creative avenues they might not have considered, increasing the quality of the ideas selected for development.

Boosting efficiency. AI streamlines key innovation processes, such as market research, ideation, and large-scale testing, decimating timelines from months to days. While human oversight remains essential, AI provides a significant head start.

Democratising creativity. Generative AI models enable all team members, not just designers, to create written and visual content. This is valuable for quickly developing designs, prototypes, or presentation materials.

Facilitating stakeholder engagement. AI enhances workshop interactivity by generating materials in real-time, aiding in the visualisation of a project’s potential impact. This helps secure stakeholder agreement and leadership support.

Optimising innovation management. AI assists large organisations in analysing innovation data, tracking activities across portfolios, projects, R&D, and scouting efforts. It provides a comprehensive overview, preventing redundant work and preserving insights from past projects.

Focusing on human elements. By automating certain tasks, AI allows team members to concentrate on uniquely human aspects of innovation, such as storytelling, to inspire leadership and secure project support.

Climate technologies can significantly affect the environment and mitigate global warming. While investors currently have $1.5 trillion invested in this sector, experts estimate that the coming years will require an additional $9 trillion to make a substantial difference. This highlights the enormous financial commitment required.

To mobilise these resources, collaboration between governments and corporations is essential. Creating a supportive environment for funding these technologies is crucial. The urgency of addressing climate change is critical, and immediate action is necessary to prevent further damage.

From a business perspective, the rapidly growing climate tech market offers numerous opportunities. Additionally, recent tech layoffs have resulted in a talent pool that is now available and potentially interested in working with corporates in this sector.

The current recession has led to lower market valuations, creating a favourable environment for corporate venture capitalists (CVCs) to invest. Unlike traditional venture capitalists (VCs), CVCs focus on long-term gains. Delaying investment until market conditions improve is not advisable. Investing in climate and sustainability initiatives can offer a substantial return, potentially yielding four dollars for every dollar invested.

Addressing climate change is urgent, with only seven years left to counteract the damage caused by decades of excess. For corporate innovation, venture building and venture investing provide the necessary speed and scale. Linda Yates’s book, “The Unicorn Within,” outlines effective methodologies for venture building and investing, providing clear guidance on implementation.

It is crucial to educate and empower executives in creating an environment where they can adopt venture building and investing strategies. Additionally, fostering bottom-up disruption is important, as many employees with specialised knowledge and experience are eager to contribute to these initiatives.

What do you think about the rising importance of topics such as Corporate-Startup Collaboration & Venture Clienting? Share your opinion with us on LinkedIn.