Corporate innovation refers to deliberately promoting original and out-of-the-box thinking within the company environment. To achieve this, many firms set up offices in co-working or other shared spaces to get to know startups and identify future markets for potential collaborations.

corporate venturing. corporate venturing platform. corporate venturing. corporate venturing platform. corporate venturing. corporate venturing platform.

Discover the innovation journey of Property Finder and Homevalue. Read about their decision-making, target selection, and expectation alignment processes. Head of innovation scouting expert and Novable’s CEO Laurent Kinet and Co-Innovation Expert Adèle Yaroulina will guide you in this journey.

Corporations are well-established businesses with a clear structure, strategy, and culture. However, they are so well-established and grounded in day-to-day activities, which takes the focus away from the future. Is your company seeking new opportunities? Does the company want to solve new challenges with innovative technologies?

On the other hand, startups have a rich entrepreneurial mindset. They are full of new ideas and talent but might lack resources. Not only financial but also expertise, knowledge, and support. Often startups want to test and develop new products and services but lack a large audience or market.

That is where the collaboration between startups and corporations can create an environment of co-innovation. This process, also known as open innovation, involves two or more partners that come together for a common purpose – an example being Mergers & Acquisitions.

During our webinar, we brought together acquirer company Property Finder, a leading real estate platform covering the sales and rental marketplace. The startup company acquired was Homevalue, a data-driven property AI-powered solution for stakeholders such as developers, consultants, investors, and asset management companies. The goal of this webinar was to understand the decision-making process they went through.

From pre-acquisition stages to post-merger integration stages, including lessons learned and pitfalls. These are the most important takeaways from our conversation:

Before thinking about merging with or acquiring a startup, the corporation’s strategy needs to be clear and shared. It needs to have a direction that will later be refined or broadened, and the resources and room for the M&A to happen in the future. Exactly what Property Finder did. As former Homevalue CEO Fouad Bekkar explained, “a critical point for the acquisition was the fact that Property Finder is a B2C company, while Homevalue was a B2B company. You do not know that until you sit down and talk about it, but the partnership was a great way to reach the final consumers”.

The process of finding the right target can either take luck, time, and too much money. However, using Novable’s platform, this process can be translated into a simple search or a deep matching campaign. It is important to not waste many financial resources and time in looking for a startup or corporation that might align with the vision of your company. In the case of Property Finder and Homevalue, their match was golden, although an opportunistic encounter within their shared ecosystems (both working in real estate in the Middle East).

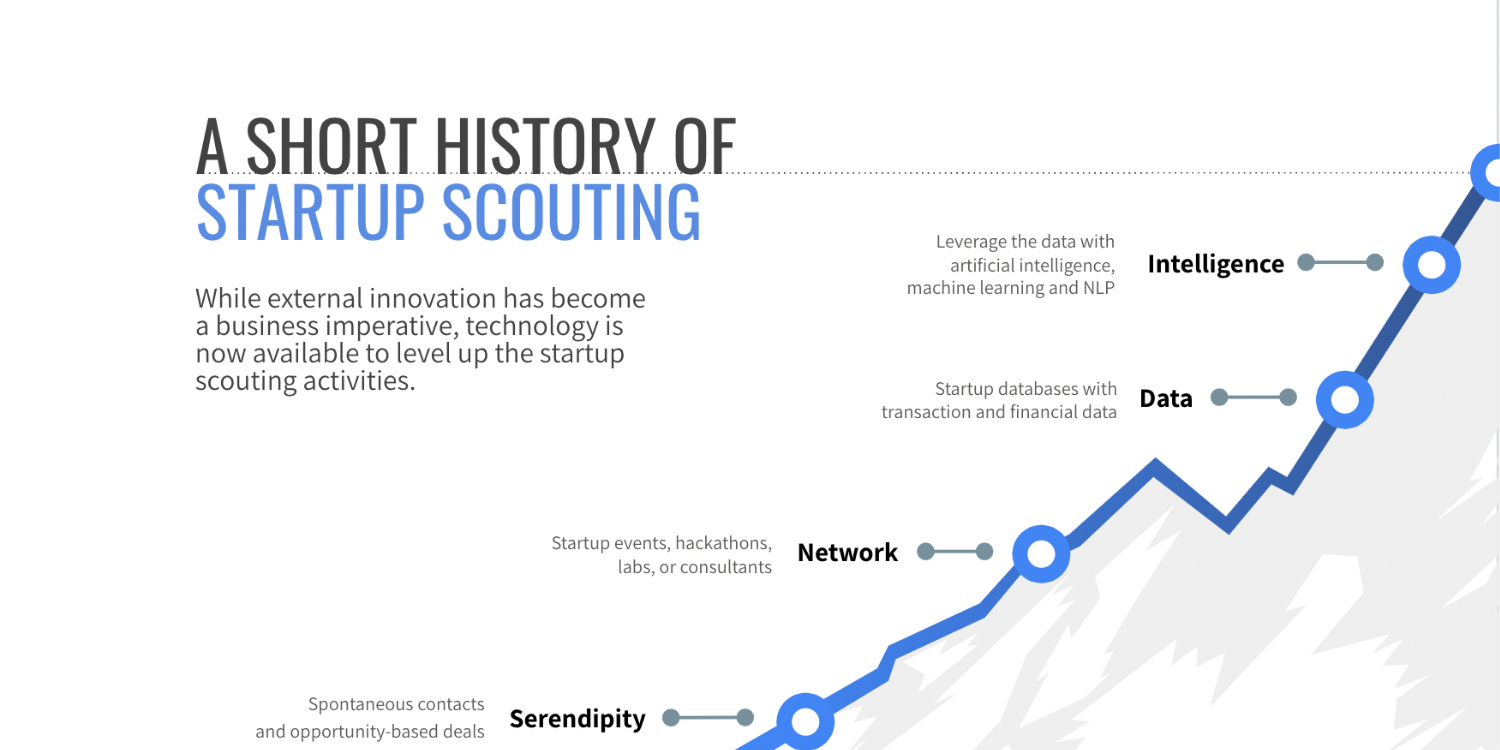

Although opportunities through serendipity (opportunity-based deals) can happen, there has been much more development in the field. One does not have to wait for an opportunity to appear but one can create opportunities. This can happen through networking events or even databases. Truth is though, these processes take much longer than using the added value of intelligence. At Novable, with Artificial Intelligence, one can define their strategy and goal on our platform. Our technology, together with our Agents, takes care of the rest. For Property Finder and Homevalue, it worked differently. Christophe de Rassenfosse explained that the first few months of interactions were used to get to know one another and speak about potentially partnering.

Fouad explained that, from Homevalue’s point of view, the process of assessing whether mutual interests would be met happened by answering questions such as,

“Can we move faster with another partner or if we move by ourselves? What are the risks and advantages of doing so?”

Because Property Finder is a market leader in the real estate industry, it also became evident that Homevalue’s audience would increase. They also took into account the growth stage of Property Finder.

On the other hand, Property Finder’s process started by identifying the use case with a clear roadmap and making sure that they would not integrate Homevalue into a system they could not deliver, referring to the fact that Homevalue operated as a B2B.

What made this acquisition so successful, in the end, was that all these points and challenges were discussed before the acquisition happened. This made sure that both sides knew the challenges and expectations to facilitate the onboarding later on.

There is no right path when it comes to partnerships, mergers, or acquisitions. Most of the time, the learning curve is built through trial and error. That was the case for Property Finder and Homevalue too. Christophe explained that, for his company, it was important to validate whether Homevalue’s team could onboard the B2C journey and align and plan important milestones. From his previous unfruitful acquisition experiences, Christophe learned that it was very important to not lose sight of the purpose of the acquisition.

Fouad’s first concern was about the uncertainty of the startup’s future. Homevalue enjoyed an entrepreneurial culture, with freedom over decision-making. Fouad did not want to lose those characteristics. However, all those concerns were mitigated by the transparency and freedom given by Property Finder.

Another concern Fouad talked about was the emotional attachment that is usually developed toward the product. However, he advised having a clear idea of what is wished to be achieved beyond the product.

Ultimately, both Christophe and Fouad agreed on the fact that communication and alignment on these important matters are the best solutions to conflict and uncertainty.

The main takeaway from this real case study? Innovation lies at each step of the way: from scouting to integration. Just like an M&A journey, there is no exact and linear journey when it comes to corporate innovation. There are many use cases, such as the one presented today.

Does your company need to get out of its close reach? Opportunities lie in different markets and industries. Novable’s platform includes more than one million listed companies, ready to tap into new ideas and technologies, and even discover unknown needs.

As we have already seen, scouting is not the first step. However, once your strategy is well defined, it will become the ultimate decision-making step. Otherwise, a bad formulation will lead to a bad selection, low expectation management, and failure.

[…] Read the most relevant takeaways from corporate venturing: from scouting to integration – an innovation journey webinar. […]