Open innovation. Open innovation. Open innovation.

Open innovation and Corporate Venturing activities are gaining traction within large organisations around the world. These practices are progressively invested by technology.

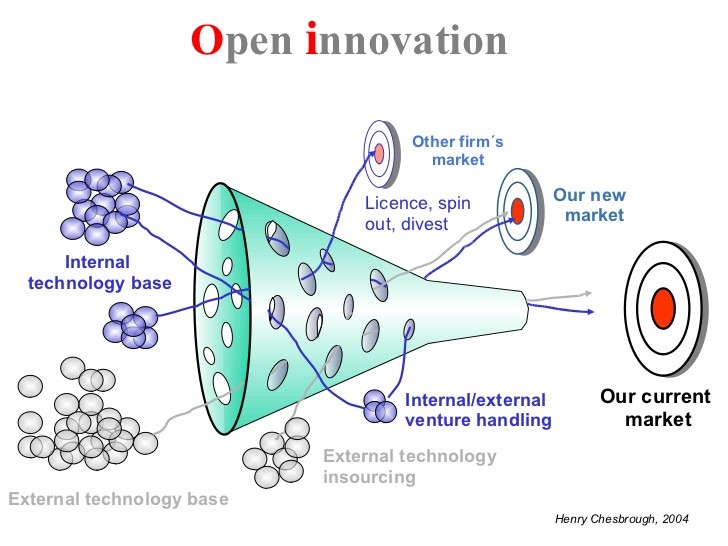

Open innovation refers to opening up your organisation’s innovation processes to external sources to acquire new concepts, cutting-edge technologies, and partnerships. There are many different ways to accomplish this, according to each company’s unique possibilities and needs.

Let’s dive into 3 main reasons why companies benefit from Open Innovation in Corporate Venturing.

Innovative companies gain an advantage by early engaging with new technologies and business opportunities. Open innovation practices enable these companies to keep up with external advancements by acquiring minority stakes in startups, participating in venture capital endeavours, or investing in promising projects at academic or research institutions. This proactive approach creates options for gathering information and understanding projects or technologies with uncertain outcomes. The benefit lies in early exposure to new technologies, with minimal and reversible investments during the exploratory phase.

Additionally, tapping into externally developed technologies broadens the scope of potential opportunities, enhancing the company’s ability to identify promising ideas and projects. By adopting open innovation strategies, companies expand their horizons beyond internal initiatives, thus increasing the likelihood of discovering diverse and uncorrelated opportunities. This diversified approach results in higher returns and improved risk management, allowing open innovation firms to build resilient project portfolios capable of withstanding challenges in any segment of the business.

The process of developing and commercialising new technologies into viable business opportunities can be compared to a multi-stage option. Unlike closed innovation, where firms rely solely on internally generated ideas, open innovation practices afford companies the flexibility to explore commercial prospects of technologies externally. This means establishing relationships with universities, small and medium enterprises (SMEs), and other innovation sources before initiating internal innovation efforts. By postponing internal investment, firms can assess a wider array of entry options upfront and devise more strategies for leveraging technology for growth.

This adaptability allows for the differentiation of innovation strategies: some companies prioritise early exploration of technologies and ideas, while others prefer to invest in more mature technologies with reduced uncertainty, making future market potential more predictable.

In open innovation models, companies retain the option to license or sell technologies or spin-off ventures that may not meet their criteria for advancement or strategic fit. This flexibility allows for the disposal of projects deemed unpromising as standalone ventures but potentially valuable as complements to other business activities. These projects can be transferred to suppliers, partners, or other external entities. By engaging multiple firms and diverse sources of investment, companies can pursue strategic initiatives without relying solely on internal capital. This approach yields two favourable outcomes: increased opportunities for innovation within a fixed budget or the ability to achieve the same level of innovation with reduced financial resources.

However, it is important to acknowledge two considerations. Firstly, firms may need to negotiate intellectual property rights to secure external investment, and secondly, the financial benefits are most significant in the early stages of innovation, as later-stage investments may incur sunk costs that are harder to recoup or reallocate.

These benefits are pushed even further thanks to the role played by AI in innovation.

Corporations increasingly turn to AI to drive innovation through venture capital investments, partnerships, and incubation programs. This transformative synergy between AI and corporate venturing not only revolutionises traditional investment approaches but also holds the promise of reshaping entire industries while unlocking competitive advantages.

In recent years, numerous real-world examples have demonstrated the tangible impact of AI on corporate venturing, illuminating a path toward a future where innovation knows no bounds.

One of the primary areas where AI is making waves in corporate venturing is investment decision-making. By leveraging advanced machine learning algorithms, corporations can analyse vast amounts of data with unparalleled speed and accuracy, uncovering hidden patterns and insights that traditional methods may overlook. For example, AI-powered innovation scouting allows venture capital firms to identify promising startups early on, enabling them to make more informed investment decisions and stay ahead of the curve.

AI is also playing a pivotal role in fostering strategic partnerships and collaborations between corporations and startups. Through AI-powered matchmaking platforms, companies can identify potential partners whose capabilities complement their own, facilitating mutually beneficial collaborations that drive innovation and accelerate growth.

Startups bring expertise and big corporations vast resources. This is key to tackling complex challenges in healthcare, climate change, renewable energy, and every industry you can think about.

Corporations are harnessing the power of AI to fuel their incubation programs and innovation labs, where startups are nurtured and supported in their journey to success. By providing access to AI tools, resources, and expertise, big companies can help startups overcome common barriers to growth and scale their innovative solutions more rapidly.

The convergence of AI and corporate venturing holds profound implications for industry disruption and competitive advantage. By embracing AI-driven innovation, corporations can gain a strategic edge by identifying and capitalising on emerging trends and market opportunities before their competitors. Furthermore, AI enables corporations to optimise their operations, enhance customer experiences, and unlock new revenue streams, positioning them as leaders in their respective industries.

AI-driven innovation in corporate venturing represents a paradigm shift in how corporations approach investment, partnership, and innovation. By harnessing the power of AI, corporations can unlock new possibilities, drive industry disruption, and secure a competitive advantage in today’s dynamic business environment. As we continue to witness the transformative impact of AI on corporate venturing, one thing is clear: the future belongs to those who dare to innovate and embrace change.

Novable wants to stay at the forefront of innovation when it comes to serving our clients with best-in-class tech products and helping them to better and faster engage with the most relevant startups worldwide.

Inspired by these topics and trends, we have launched a large survey among innovation professionals, to gather opinions and trends in the area of Open Innovation, and about the way technology might help fulfil new needs. You can fill in the survey here.

You can contribute to this survey by answering 5 questions. It will take you less than 3 minutes.

We will then conduct an in-depth analysis of the results and build a report from it. Thank you in advance for your time, looking forward to sharing the findings with you.

What is your opinion on the topic? Share your thoughts with us on LinkedIn!