This article will review “The Gorilla Game: Picking Winners in High Technology” by Geoffrey A. Moore, Paul Johnson, and Tom Kippola.

The book focuses on investing in technology stocks, specifically identifying companies with the potential to dominate their markets, known as gorillas. The authors draw parallels between the strategies used by dominant tech companies and the behaviour of gorillas in the wild.

Source: Investing in new technologies

Let’s begin by explaining the Technology Adoption Lifecycle discussed in the book. This represents an adaptation of a model developed by Everett Rogers as part of the Diffusion of Innovation Theory.

Source: Technology adoption lifecycle

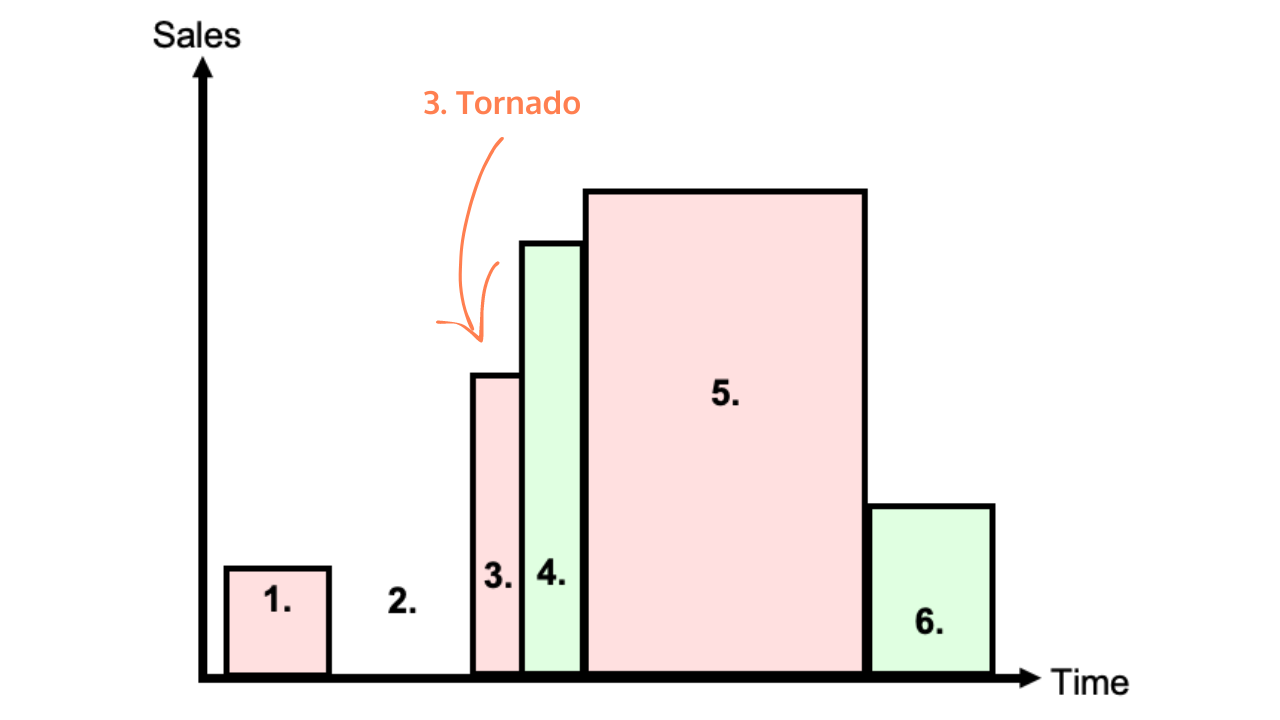

In a technological upheaval, numerous companies strive for dominance by offering competing standards for a new technology. However, one company eventually surges ahead, often due to superior marketing, product quality, or other factors. Once this leading company establishes itself, the market rallies behind it, and the company becomes a ‘gorilla.’

This period is defined as “tornado” in the book, and it corresponds to the third point on the graph previously shown.

A “gorilla” is a company that dominates the market for a particular technology, maintaining this position throughout the technology’s life cycle. The market valuation of the standard-setting gorilla significantly surpasses its competitors, creating substantial stockholder wealth.

The long-term competitive advantages of gorillas are outlined as:

Microsoft. Arguably the most successful gorilla in history, the company saw a 20,000% increase in market capitalization from $600 million in 1986 to $130 billion ten years later.

Intel. From 1990 to 1996, the company’s stock increased 1,200%, yielding an average annual rate of return of 44.3%.

Cisco Systems saw their share values increase 100 times between April 1990 and June 1997, when they went public.

1. Determine which consumer markets are about to enter a hyper-growth phase.

The process involves recognising the establishment of a new value chain and anticipating the introduction of a new product into the mainstream consumer market to kickstart sales.

Practically, the most effective approach to pinpoint these burgeoning hyper growth prospects is to acquire substantial industry knowledge by subscribing to essential trade magazines covering the high-technology sector and keeping an eye on Internet-based news sites focusing on the high-tech field.

2. Invest in all businesses that provide products to the market and have a reasonable prospect of going global.

Since it is impossible to predict with any degree of accuracy which company will become a gorilla and take the lead in the market, your first course of action should be to own some equity in each and keep a close eye on how things develop.

3. Sell all of your competitors’ stock and combine your stock holdings in the gorilla once a gorilla or market leader emerges.

The fundamental idea is that you can maximise your returns by entering a hyper-growth market and focusing your investments on the one successful gorilla out of all possible gorillas. Gorilla stocks consistently outperform the market over the long run, so while it may seem counterintuitive at first, the idea of taking the money invested in the also-rans and reinvesting in the gorilla makes sense.

4. Continue to have a long investment horizon.

The goal of gorilla investing is not to make money by making quick purchases and sales. Investing in quality companies that have the potential to outperform the market over time is a “buy-and-hold” strategy.

5. Don’t sell your gorilla stock until a rival industry appears and poses a threat to the gorilla’s clientele.

Not even a very established gorilla can survive indefinitely. A gorilla may occasionally encounter sudden external threats, but more frequently, outside events have a very gradual impact on operations.

Advantages

These principles offer substantial potential to generate impressive returns on investment. By diligently conducting research, investors can minimise risk, focusing on companies entering hyper growth markets. Moreover, they enjoy flexibility in timing their buying or selling actions. The principles also provide leeway, accommodating periods when investors may be engaged in other projects.

Disadvantages

Successful implementation of these principles demands discipline. Investors must make rational decisions, avoiding impulsive actions, contrarian investments, or blindly following market trends. Investors need to invest time in thorough research to stay updated with the dynamic high-tech industry. While information is readily available, allocating time for research is essential. Adhering to these principles may lead to missing out on investing in speculative stocks that could potentially yield substantial windfalls.

“The Gorilla Game” offers a compelling framework for investors seeking to navigate the unpredictable world of technology stocks. The authors provide a comprehensive guide to identifying potential market leaders, emphasising the importance of technological prowess and sustained growth.

One of the strengths of the book is its practical approach, backed by real-world case studies that illustrate the success stories of companies that have effectively played the gorilla game. The emphasis on market dynamics, the technology adoption life cycle, and the identification of key criteria for potential gorillas adds depth to the book.

The book does not shy away from addressing the risks associated with tech investments, providing a balanced perspective on the challenges investors may face. Additionally, the insights into future trends offer valuable foresight for investors looking to stay ahead in the fast-paced tech industry.

What do you think about this book? Did you read it? Share your thoughts with us on LinkedIn!