In 2014, Gregor Gimmy coined the term “Venture Client”. Back then, it was not known by startups and venture capitalists. At the time, he conceptualised an approach by which BMW could benefit from better startups, more effectively, faster, and at lower risk. However, the focus was on CVCs (corporate venture capital).

“Become a Venture Client, instead of a venture investor.”

With that goal in mind, he created a specific Venture Client process, developed special resources, and established a new decision-making value system. The result was the BMW Startup Garage, the world’s first official Venture Client Unit. It had its special Venture Clienting process by which it selected startup-relevant problems, and problem-relevant startups.

Nowadays, companies all around the world practice Venture Clienting actively. The “State of Venture Client Report” collects real-world data about Venture Clienting to further research, ultimately resulting in better outcomes.

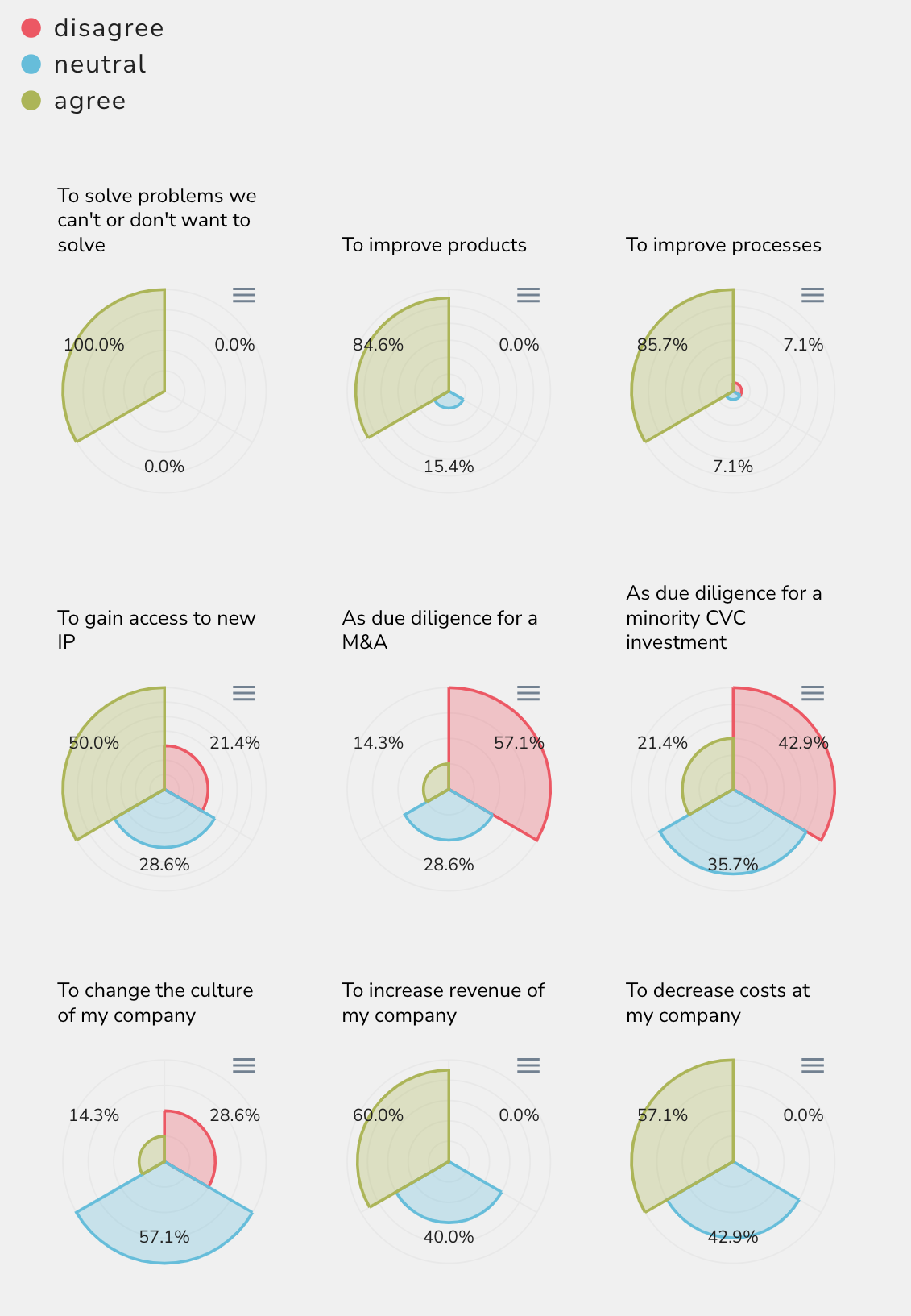

Question to Venture Client companies: What are the reasons for your company to buy from startups?

A Venture Client is a company that buys and employs startup products to incorporate them into its business operations. Venture Clients look out for the most promising startups to assist them in addressing specific business difficulties, optimising processes, or improving the entire customer experience. After all, startups would not exist if other organisations did not employ their products. As a result, hundreds of thousands of Venture Clients range from large enterprises to small, ten-person firms (Gregor Gimmy).

Selling to big corporations is challenging since it requires time to identify the appropriate stakeholders and launch the process. Purchasing from startups can be made faster, more accountable, and more productive with the aid of a Venture Client Unit.

“This report aimed to investigate the current state of Venture Client among two actors: Venture Clients and startups.”

Startups provide the best solutions and Venture Clients are businesses that take a risk and purchase, utilise, and adopt startup products to address urgent strategic issues. The majority of businesses purchase products from startups without a defined, institutionalised plan, procedure, or funding. An increasing number of businesses have established specialised units that function according to a particular model in an effort to become better Venture Clients, that is, to be able to generate more strategic benefits from the startup ecosystem faster and more effectively. These include companies like Siemens, Holcim, BMW, Airbus, and Bosch. Because the model is new, not much is known about how Venture Client operations are currently operating globally, how the model is distributed, or what best practices are in this regard.

Being the first report on this topic, the goal is to close a research gap and add the model to the research agenda of numerous academic disciplines. The study provides insight into the motivations and methods by which venture capital firms purchase products from startups and vice versa. It covers important questions concerning the Model of startups and company representatives.

“How are companies structuring their Venture Client process?”

“In what areas and for what reasons are companies buying from startups?”

“What resources are companies using to conduct Venture Client activities?”

“What challenges and benefits are companies and startups facing to accomplish their Venture Client goals?”

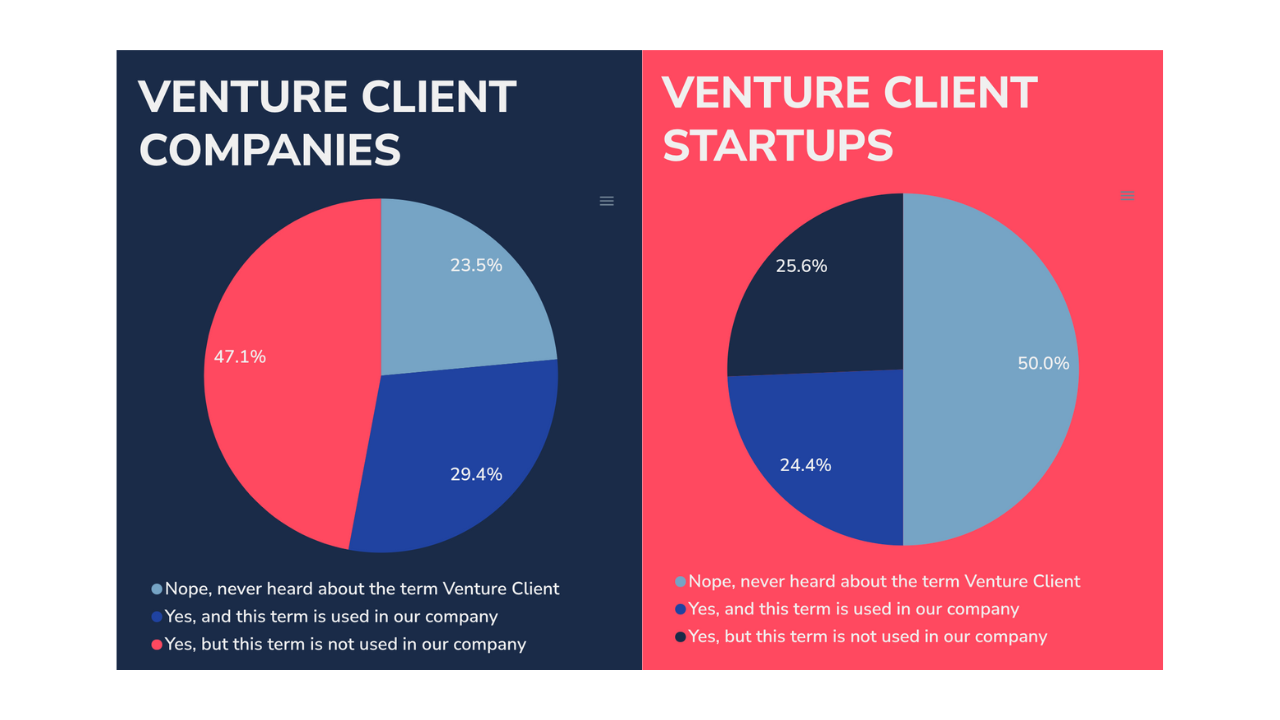

The actual practice of purchasing from startups is still not fully supported by terminology. It is uncommon for businesses to refer to one another as “Venture Clients,” despite the fact that many are already using the model or certain aspects of the process. Furthermore, businesses are still unaware that age or culture is not what sets startups apart from corporations. Startups are recognised legal entities that are funded heavily by Venture Capital, have a team of industry experts on staff, and own patents.

“Buying from startups involves several organisational units within a company. Taking a deep dive into this question, Venture Clients claim that the purchasing process is mostly conducted by innovation departments (50%). Other departments involved are business development (43%), legal (43%) and procurement departments (36%), whereas a dedicated Venture Client Unit is only existent at 36% of the participating companies and at 41% of participating startup’s clients.”

Startups place less value on mentoring and instead favour lean decision-making during the purchasing process as well as customer feedback on the product. A startup should strive for a precise problem definition, regardless of whether it is related to processes or products, as well as scalable purchase orders. There are strategic advantages to using a structured Venture Client model for both the established business and the startup. But as of right now, businesses don’t have definite KPIs in place to measure how well their operations are working.

The Venture Client Model is becoming more and more popular. Companies need to invest in specialised Venture Client Units and create best practices for applying this open innovation strategy in order to fully realise the potential of the model. It would be useful to perform the survey annually for the upcoming reports in order to track the model’s development. In addition, expanding the sample size would allow the performance of more in-depth analysis, like country comparisons.

The “State of Venture Client Report” by Gregor Gimmy (CEO at 27pilots) and Sebastian Schafer (Venture Client solutions lead at 27pilots) is a remarkable guide that dives deep into the intricacies of Venture Clienting, offering a comprehensive and well-structured exploration of this dynamic field. This e-book showcases data about the current scenario and takes readers on a journey through the fundamental concepts, strategic approaches, and practical applications of the Venture Client Model.

The report is a must-read for anyone seeking a comprehensive guide to this rapidly evolving field. The level of expertise, coupled with the well-organised structure, makes it an invaluable resource for entrepreneurs, corporate leaders, and anyone interested in the intersection of innovation and corporate strategy!

What is your opinion on the topic? Did you know the term Venture Client? Share your thoughts with us on LinkedIn!