competitive landscape. competitive landscape. competitive landscape. competitive landscape analysis. competitive landscape analysis. competitive landscape. competitive landscape. competitive landscape analysis.

The examination of competitors within a market offers insights into individual businesses’ operations. Utilising the results of this analysis can propel businesses to a leading position within their industry. Familiarity with competitive analysis is instrumental in contributing to a company’s achievements and sidestepping typical pitfalls. This article explores the concept of a competitive landscape, delineates its benefits, outlines its structure, and underscores the process of crafting a competitive context analysis.

Competitive landscape analysis is a strategic business tool employed by companies to identify their market competitors. This involves recognising both direct and indirect competitors, along with their respective strengths and weaknesses. Establishing an accurate landscape necessitates conducting a competitive context analysis and thorough research specific to the interested industry. This research endeavour typically involves understanding market dynamics, identifying opportunities for improvement, addressing operational challenges, and devising appropriate solutions.

For instance, consider a scenario where a coffee shop wishes to assess its competitive environment. Initially, the shop outlines its offerings and sales strategies. Subsequently, within the competitive analysis framework, it categorises menu items and investigates competing options. It may discover that competitors extend beyond traditional coffee shops to include bakeries and diners offering similar products. Armed with this information, the coffee shop can adapt its approach, perhaps by refining its menu or diversifying its product range.

Clarifying the target market. This approach assists in distinguishing a business from its competitors and effectively conveying messages to customers. By analysing specific markets, companies can pinpoint areas where their competitors have particular shortcomings and outperform them. Moreover, they can refine their marketing strategies to attract more customers.

Spotting trends. Competitive analysis reveals shifts in business and consumer trends, ensuring the company maintains its uniqueness in the market and stays abreast of current trends.

Identifying market gaps. Monitoring competitors’ operations and offerings helps identify underserved consumer segments. This enables companies to target these overlooked consumer groups and capture significant market share.

Sustaining competitiveness. Thorough research on competitors’ product development plans enables companies to stay competitive. Understanding competitors’ products allows businesses to develop strategies such as offering similar products at lower prices or higher quality, maintaining competitiveness in the market.

Enhancing employee skills. Competitive analysis uncovers competitors’ marketing strategies, prompting businesses to develop more effective plans to attract customers. This competitive environment fosters skill development among employees, potentially leading to the implementation of marketing training programs. Analysing competitors’ actions also cultivates a competitive mindset among employees, enabling them to identify partnership opportunities and expand the business’s product offerings effectively.

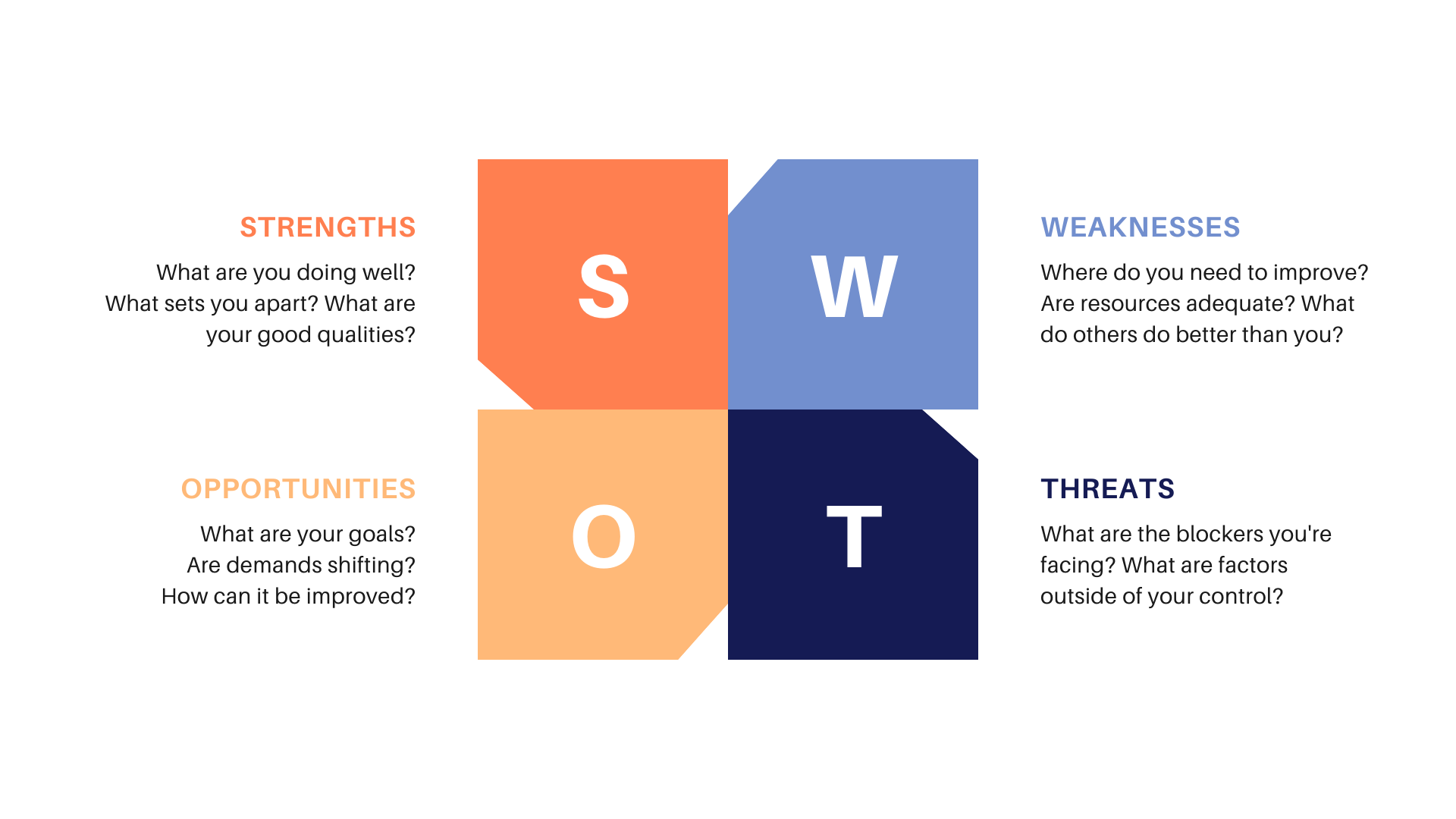

Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis

This framework evaluates internal and external factors influencing a business’s success, highlighting potential competitive advantages.

Political, Economic, Social, Technological, Environmental, and Legal (PESTEL) Analysis

Source: FreePik

Political factors encompass government policies, regulations, political stability, and geopolitical issues that can influence business operations. It includes aspects such as taxation policies, trade tariffs, government stability, and regulatory frameworks.

Economic factors refer to the broader economic conditions within which a business operates, including economic growth rates, inflation rates, interest rates, exchange rates, and overall economic stability. These factors can impact consumer purchasing power, demand for goods and services, and the cost of doing business.

Social factors pertain to demographic trends, cultural norms, lifestyle changes, and societal attitudes that can affect consumer behaviour and market demand. It includes aspects such as population demographics, lifestyle preferences, cultural values, and social attitudes toward issues like sustainability and health.

Technological factors deal with technological advancements, innovations, and developments that can impact industry dynamics and business operations. It includes automation, digitalization, research and development (R&D) activities, and disruptive technologies that can create new opportunities or threats for businesses.

Environmental factors relate to ecological and environmental issues that can affect business operations and sustainability. It includes aspects such as climate change, environmental regulations, sustainability practices, and resource availability that can impact industries like energy, manufacturing, and transportation.

Legal factors refer to laws, regulations, and legal frameworks that govern business operations and industry practices. It includes aspects such as employment laws, consumer protection regulations, industry-specific regulations, and intellectual property rights that can impact business activities and strategies.

Positional mapping

This framework plots businesses on a graph based on common features, facilitating comparison and evaluation. For example, a manufacturer may compare price and performance of products relative to competitors.

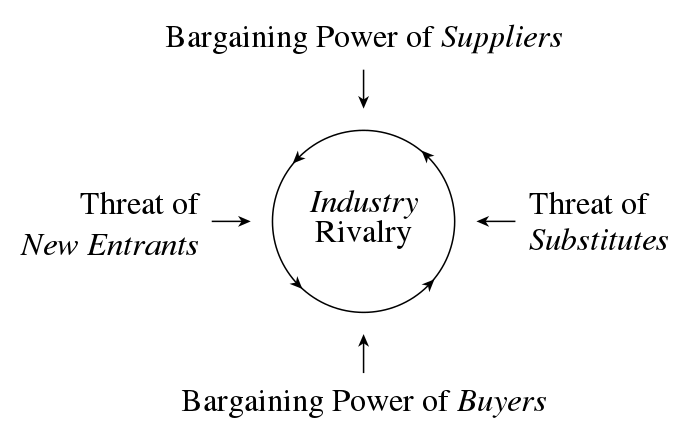

Porter’s five forces

Source: Porter’s 5 forces

Porter’s model assesses five factors impacting a business’s profitability, particularly useful for new ventures or industries.

Threat of new entrants. How easy is it for new competitors to enter the industry? Are there significant barriers to entry such as high capital requirements, economies of scale, or strict government regulations? What is the likelihood of new entrants disrupting the market and competing for market share?

Bargaining power of buyers. How much influence do buyers have on pricing and terms? Are there many buyers with significant purchasing power, or are there only a few large buyers? Can buyers easily switch to alternative suppliers or substitute products?

Threat of substitutes. What alternatives exist for the products or services offered by the industry? How readily available are substitutes, and how do their prices and quality compare? Are there any emerging technologies or trends that could potentially replace the industry’s offerings?

Bargaining power of suppliers. How much power do suppliers have in setting prices and terms? Are there few suppliers with significant control over key inputs or resources? Are there alternative sources of supply, or is the industry dependent on a limited number of suppliers?

Industry rivalry. How intense is the competition among existing firms in the industry? Are there many competitors of similar size and strength, or is there a dominant player? What are the industry’s growth prospects, and how does this affect competition for market share?

Strategic group analysis

This approach groups companies based on shared characteristics like marketing strategies or market share, aiding in identifying the closest competitors and evaluating service or product offerings.

Identify your competitors. Compile a detailed list of both new and established businesses, outlining their products or services on a spreadsheet for an accurate assessment. Novable can help here.

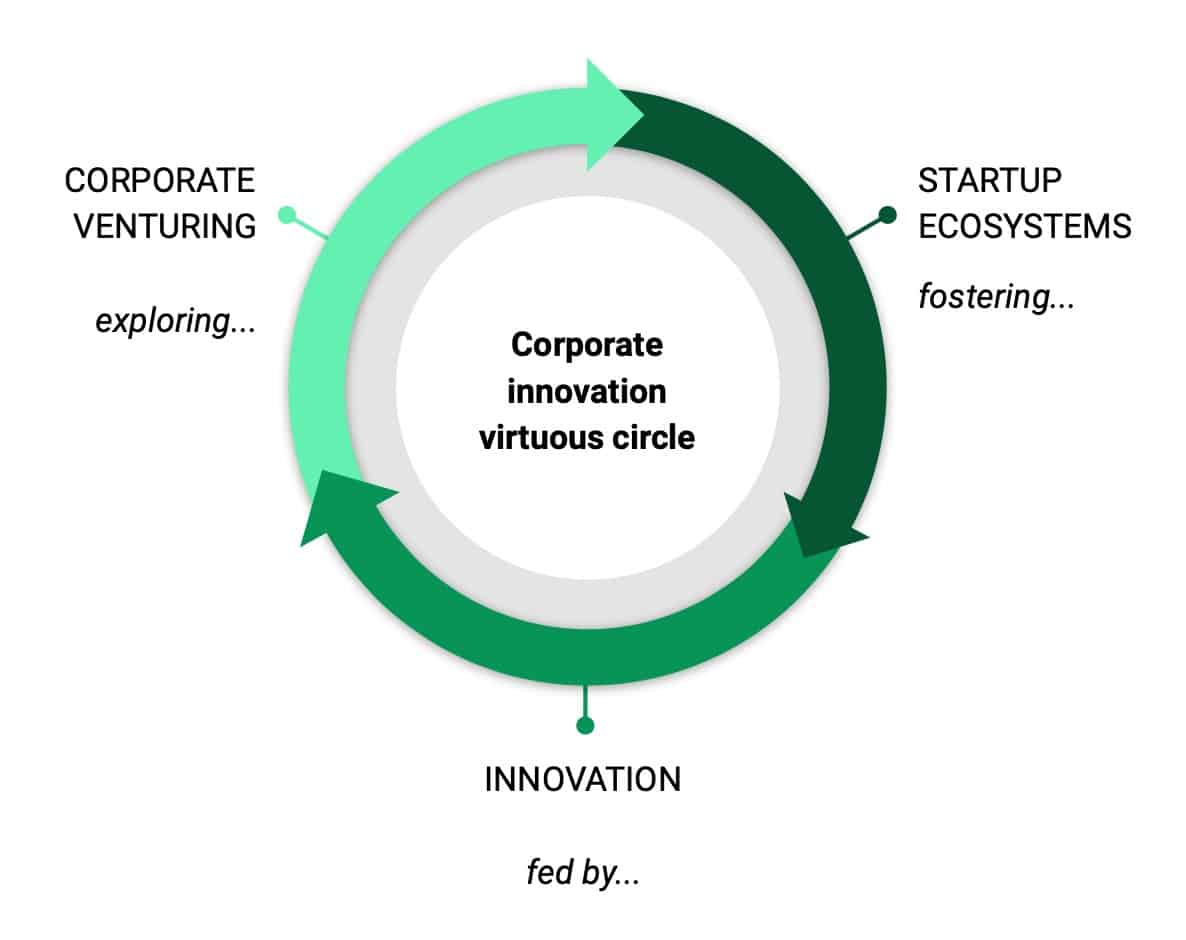

Everything in life sparks from ideas. The moment an idea crosses your mind, you are the only or first person in the world to have it – or so you think because dozens of others will have had it before you. No idea is truly, completely new, as the result of collective, incremental thinking.

There is a theory on this effect: the Multiple Discovery concept, also referred to as Simultaneous Invention. It assumes that most ideas, discoveries, and inventions are made independently and more or less simultaneously by multiple people. By extension, having an idea means that someone else had it before.

However, ideas are protean and heterogeneous, and their execution widely differs. This is where a background check is useful. Not only to check if your idea is unique (hint: it is not) but also to discover how it is deployed elsewhere. At worst, you will change your mind; at best, you will get inspired by your peers and roll out your idea in a better way. Check if your idea already exists and gain a more comprehensive understanding of your competition out there.

Then, classify competitors into distinct categories to monitor their impact on business success, including:

Then, classify competitors into distinct categories to monitor their impact on business success, including:

Conduct competitor research. Brand development is pivotal in shaping consumer perceptions and driving sales. Analyse competitors’ branding strategies to inform and differentiate your own company’s brand. Utilise social media platforms and websites to gather insights into competitors’ products/services, pricing structures, marketing tactics, and customer relations strategies.

Analyse findings. Ask pertinent questions to discern competitors’ operations and identify areas for differentiation and improvement within your own business:

What is your opinion on the topic? Have you analysed your competitive landscape yet? Tell us more on LinkedIn!