Large companies that fail to adapt risk following the path of once-mighty players like Compaq, and Polaroid. Each of these giants once dominated their industry, only to collapse under the weight of missed market shifts and a lack of forward-looking vision.

The numbers speak for themselves:

This reality elevates Corporate Venturing, the practice of partnering, collaborating, investing, or acquiring startups from a “nice-to-have” into a strategic necessity.

The COVID-19 pandemic accelerated this shift. Digital transformation became non-negotiable, and delegating the discovery of startups to AI-powered tools emerged as the logical next step in corporate venturing strategies.

If these ideas resonate, explore how we support startup scouting for corporate innovation to make such transformations possible.

It is often said that startups allow corporations to survive. In truth, the opposite is equally valid: corporate venturing fuels the very existence of startup ecosystems.

For most startup founders, the endgame is acquisition by a larger company. IPOs remain rare, while being acquired by a corporate partner offers both financial security and the opportunity to scale. Without consistent venturing activity from mature players, entrepreneurial ecosystems would stagnate, innovation pipelines would shrink, and fewer bold ideas would see the light of day.

In short, low venturing equals low innovation. Corporate venturing forms the beginning and the end of a virtuous cycle of entrepreneurship.

You might also find value in reading more on Novable’s Corporate Venturing Framework, a structured methodology to guide innovation teams.

Despite its importance, corporate venturing practices remain stuck in outdated methods. Most connections between startups and corporates are still forged through chance encounters at events, hackathons, or resource-intensive research projects.

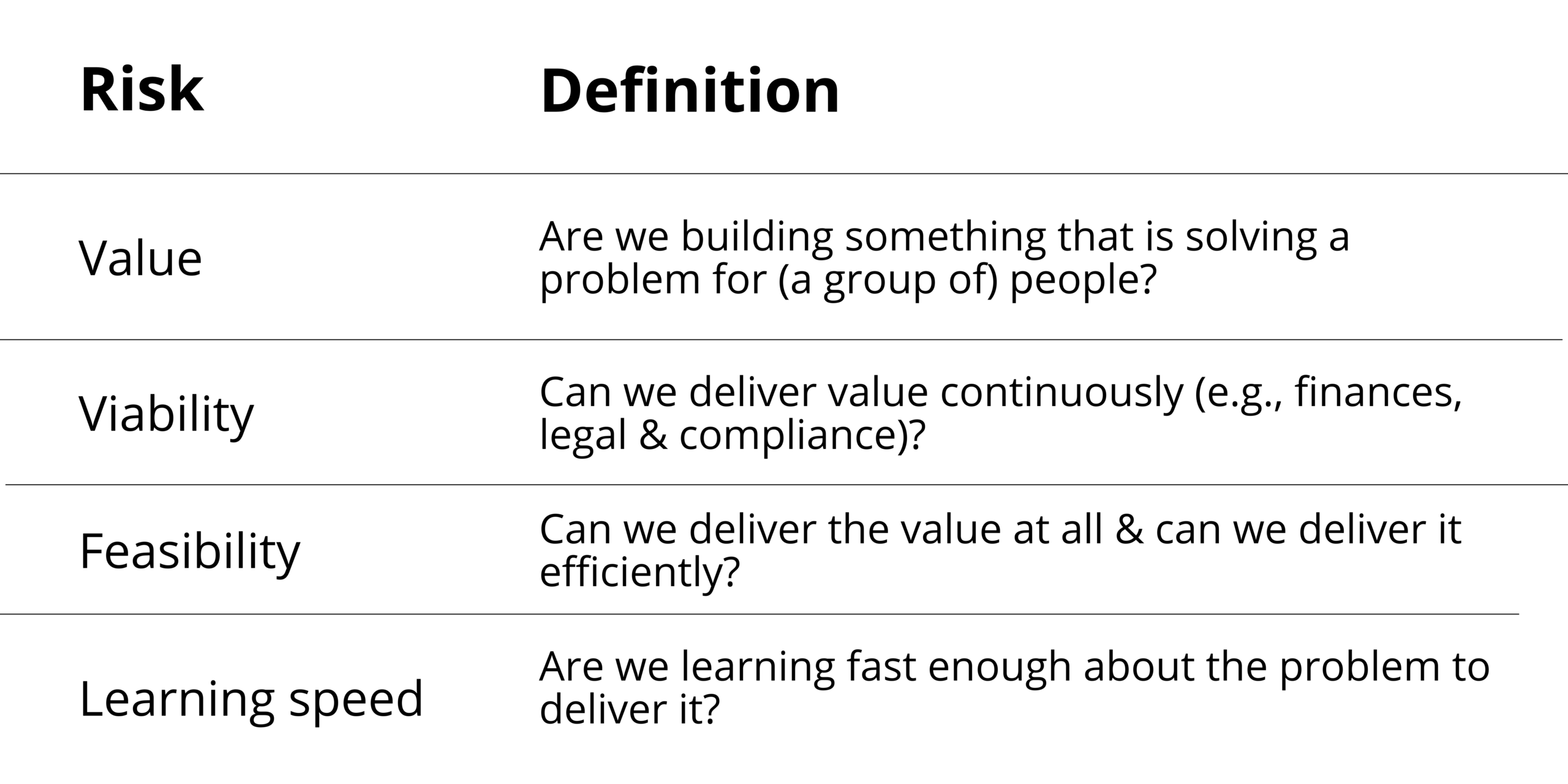

This approach creates several bottlenecks:

Consultants – Costly manual processes that lack scale.

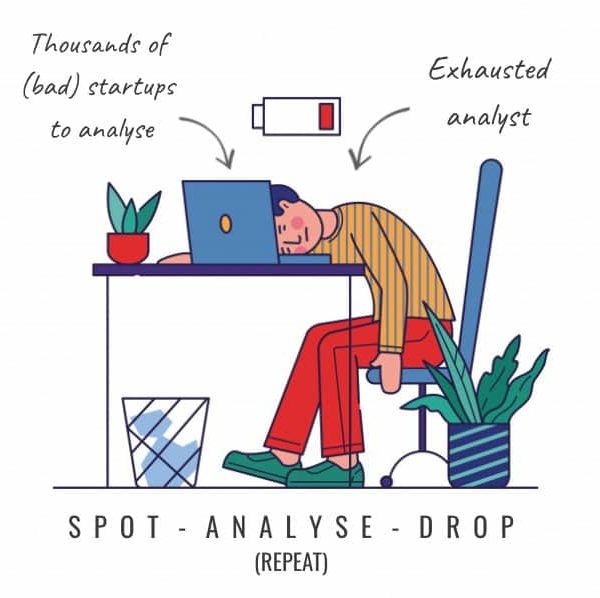

For innovation professionals, this creates what Novable calls the “SAD Syndrome”: Spot → Analyse → Drop. Less than 1% of scouted startups result in engagement, wasting thousands of hours of corporate time.

The bottom line: with 472 million entrepreneurs worldwide and a new business launching every three seconds, traditional scouting is either prohibitively expensive for large corporations or inefficient for mid-sized firms.

At Novable, we believe there’s a better way. We built an AI-powered startup scouting engine designed to understand your unique corporate strategy and deliver the most relevant companies within seconds. Our Novable Experts are the heart of this engine.

Our mission is simple, we want to empower innovation through startup relations by connecting the brightest entrepreneurial minds with strong corporate ambitions. By doing so, we transform scouting from a manual, high-friction task into an efficient, insight-driven process.

Key benefits:

We are part of the market research industry, offering insights rather than raw data. Our AI-powered platform + Novable Experts assess founding teams, product originality, and innovation potential factors that financial platforms often overlook.

To see how this works in practice, explore our client stories – real examples of successful corporate-startup engagements.

Novable’s approach rests on four strategic pillars that redefine startup scouting:

If you’d like help implementing innovation programs in your company, consider our professional services which include workshops, strategy alignment, and tailored execution.

Corporate venturing – strategic alliances between established companies and startups – has become an invaluable tool for accelerating innovation. Benefits include:

Ultimately, corporate venturing diminishes risk, accelerates time-to-market, and offers a cost-effective pathway to innovation. Discover more about our approach in Novable’s professional services.

The future of corporate venturing lies in combining human intelligence with artificial intelligence. Computers cannot replicate the strategic vision, sensitivity, or negotiation skills of innovation leaders. But they can handle 80% of the analysis workload, turning scouting from a bottleneck into a growth engine.

By adopting AI-powered scouting, corporations can:

Accelerate the innovation lifecycle from exploration to engagement.

At Novable, we believe corporate venturing should be efficient, scalable, and deeply personalized. With AI as your ally, you can stop wasting time shifting through irrelevant startups and start building meaningful partnerships that shape the future.

If you would like to elaborate on the topic, make sure to read our White Paper and explore the full framework.

Prefer to dive deeper first? Book a discovery call with a Novable Expert today to see how AI-powered scouting can transform your innovation journey.